Adxstudio7 vs MSCRM Portal8

March 20, 2017

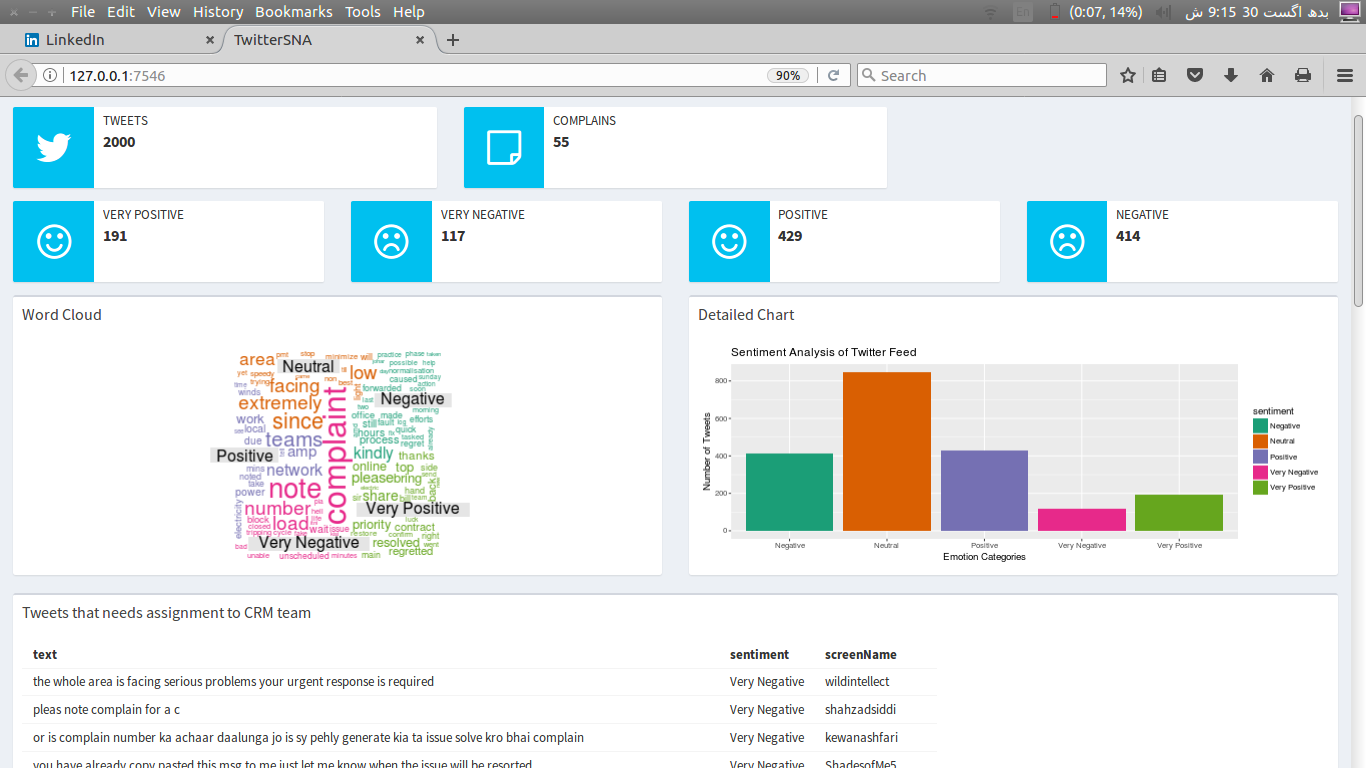

Sentiment Analysis using R & Shiny – An example

September 13, 2017Changes in the financial technology domain have now made it possible to use QR code as primary point of payment origination from merchant locations within the retail universe.

The $200 POS is going to get replace by a printed piece of paper.

This must be an an extinction level event for the POS industry in a frontier market like Pakistan.

Lets take a look at the POS enabled payments landscape:

Currently there are 52,854 POS units deployed in all of Pakistan (ref: SBP PS-Review-Q3FY17) Dynamics of acquiring these POS merchants, their risk assessment, cost of interchange, MDR for consumers and average ticket size has kept the growth not only slow but also excluded large number of merchants from the acquiring markets. On top this there is cost of maintaining the POS and making sure that merchant keeps on providing it with the necessary, like electricity, telco connection and their backups. Also let us not forget the learning curve at the retail.

So what is a QR code

QR Code is the front foot of push payments technology allowing users to experience cash like transaction in a digital world. It is a machine-readable code consisting of an array of black and white squares, which when scanned from a smart phone allows to read the information stored in the code and take action on it.

Lets start with basics

What is a push payment?

When a payment is made as a credit transfer (push payment) from the consumer’s financial institution to the merchant, as opposed to a debit transfer (pull payment) it is called a push payment. Payment is made directly from the consumer’s account rather than through a third-party account.

How does it work?

- Consumer scans QR code at retail using smart phone app.

- App is linked to bank account

- Bank deducts payment from consumer account

- Payment is routed instantly to the merchant bank account

- Merchant gets the instant payment deposit

- Goods or services are dispensed

How did it use to work in the POS world?

- Consumer scans card at retail using the merchant owned POS

- Card Info is sent across multiple networks

- If the information is correct the bank will pull the payment from your account and hold it for a while.

- Merchant will get a notification that yes someone reliable now has their funds and it will provide it to the merchant in few days time.

- Upon getting notified the merchant dispenses required goods or services

- All this while the consumer remains scared and unsure if their card information was compromised at any stage and the merchant remains scared of a charge back – giving birth to the whole of risk industry.

In any other market my conclusion would have been that QR code is only here to complement the POS market but given the size. However the nascencey of the POS market in Pakistan coupled with the technology acceleration and the fact that the eco system required for QR payments is already half cooked in form the 12 banks that are already providing the mobile banking apps (which forms the back of the qr issuance network) shows that QR acquiring will outstrip the POS acquiring.

What remains to be seen is the rate at which this new payment method grows. Banks at first will be worried about cannibalization of their hard hard POS merchants and might even view this with suspicion. However the lowered interchange should act as a catalyst.

One more thing if done right could really rocket the QR growth is standardization of QR code issuance at a national level. This will allow for trend to cross any adoption hurdles that might exist in the current landscape.

In any case time to say good bye to the POS!