About The Customer

A stealth startup headed by industry professionals working to resolve:

- Access To Trade Finance

- Democratization of Trade Finance Instruments like Letters of Credit

Problem Statement

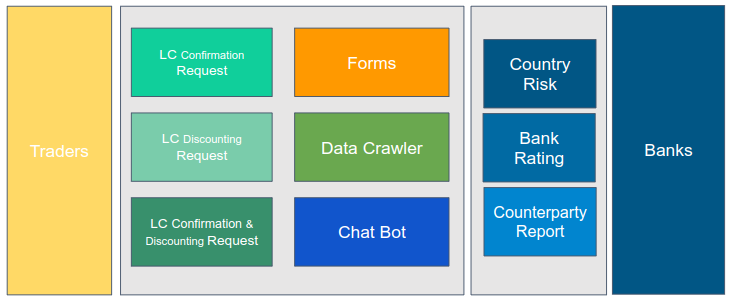

The requirement was for a two-sided web-based platform that would allow traders access to a digital trading window using which they a trader could create trade finance requests (Letters of Credit and Bills of Collection). Banks would bid their services and rates on this request allowing the customer to accept or reject the rates. The platform also allowed for Risk Participation for participating banks.

The major challenge was to figure out the Country Risk, Bank Risk and Customer and country party credit report, without which the trade request would not have much value.

Our Approach

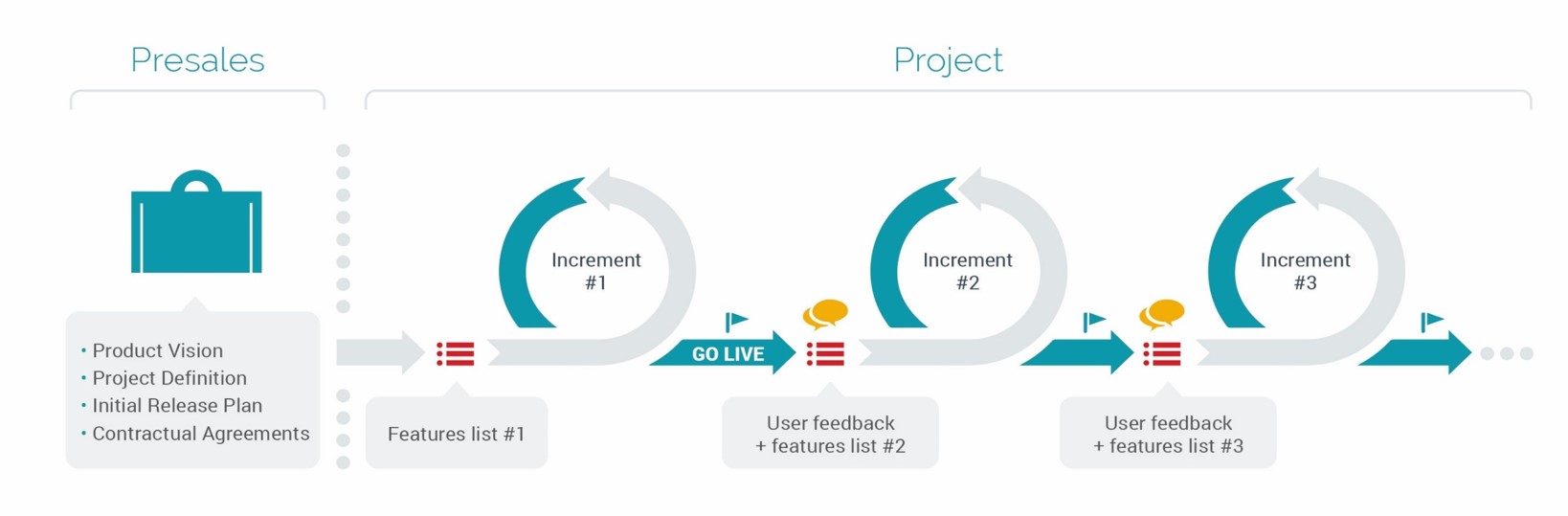

A project involving such complex cross-border banking instruments required that we start with detailed requirement analysis. Create detailed workflows, understand the complexities involved and build a user experience that would allow easy adoption both by the bank and by the end customer. We decided to build a core body of knowledge before the project started and then use that to create features and built then using development sprint.

Our Solution

We designed a web application and powered them with bots that would fetch Country Risk, Bank Risk, and Counterparty risk. To enhance the user experience we even built a chat bot that would interact with the customer allowing them to easily fill out the Letter Of Credit and Bill of Collection Application.

The system was made MT-700 message compliant for bank users so that they could easily move in between their existing SWIFT systems and our application.

Success Factors

- Digita’lization Of Trade journey

- Improve Cost to Income Ratio for Trade Finance

- Faster & accurate instrument risk assessment at scale!

- Instant Access to Rates & Trade Facilities

- Interoperability In Trade- MT-700 compliant

- Live Chat with bankers