About The Customer

A stealth startup headed by industry professionals working to resolve:

- Access To Trade Finance

- Democratization of Trade Finance Instruments like Letters of Credit

Problem Statement

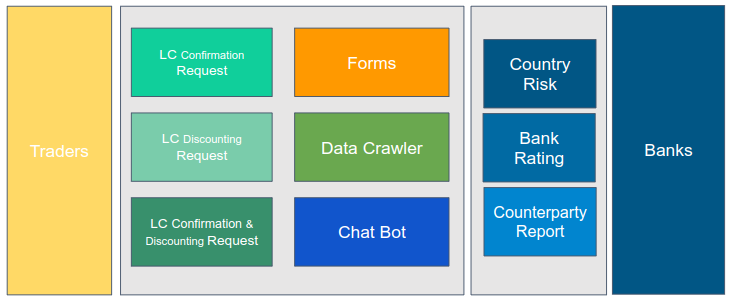

The client needed a secure, scalable two-sided web platform that would:

- Enable traders to create and submit trade finance requests digitally

- Allow banks to review these requests and submit competitive bids for Letters of Credit (LCs) and Bills of Collection

- Facilitate traders in accepting or rejecting the offers based on terms and pricing

- Support Risk Participation by multiple banks

A key technical challenge was integrating real-time risk assessment mechanisms, including:

- Country Risk

- Bank Risk

- Counterparty Credit Reports

Without this, trade finance requests would lack credibility and impact.

Our Approach

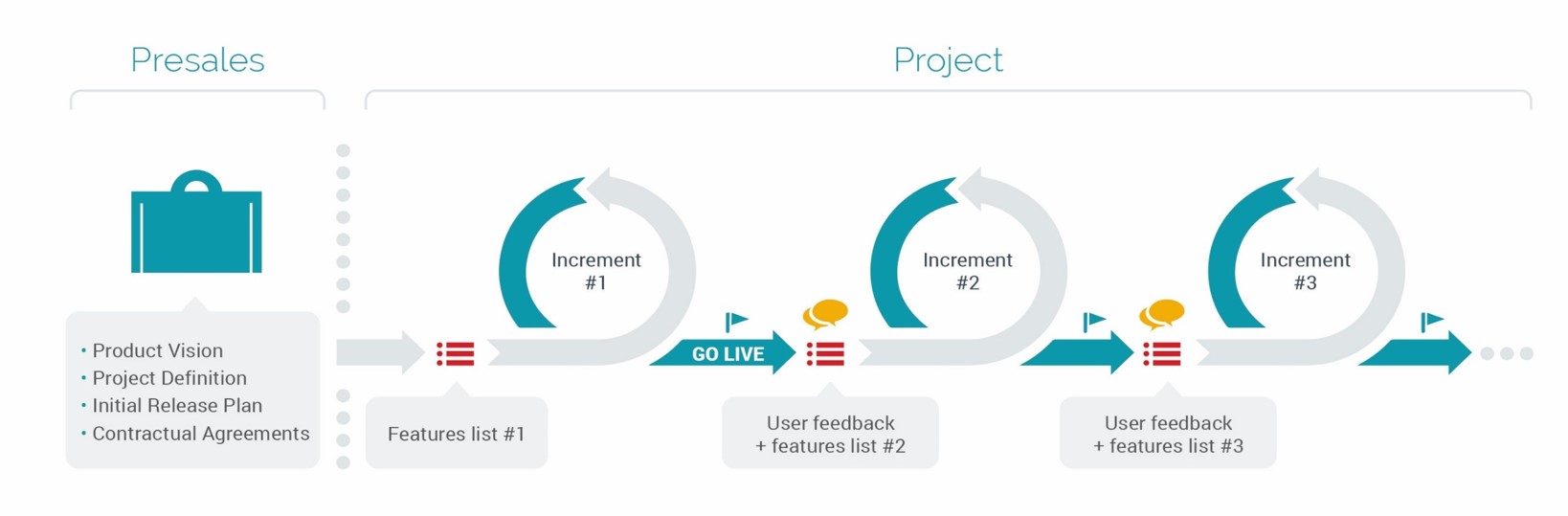

We began with a deep-dive requirements analysis and co-created a knowledge base with the client to navigate the complex landscape of cross-border trade finance. Our approach emphasized:

- Defining intuitive user workflows

- Creating a user-friendly interface for both bank and trader segments

- Prioritizing compliance with international standards such as SWIFT MT-700 for seamless banking integration

- Executing development in agile sprints for continuous feedback and improvement

Our Solution

We designed a web application and powered them with bots that would fetch Country Risk, Bank Risk, and Counterparty risk.

To enhance the user experience we even built a chat bot that would interact with the customer allowing them to easily fill out the Letter Of Credit and Bill of Collection Application.

The system was made MT-700 message compliant for bank users so that they could easily move in between their existing SWIFT systems and our application.

Techical Architecture

We architected a robust, containerized web application using Python and Django, designed to handle high-stakes trade finance interactions with security and speed.

Key Features & Technologies:

- AI Chatbot for Natural Language LC Requests Using Rasa, we built a conversational chatbot capable of understanding and processing Letter of Credit applications in natural language, simplifying the data entry process for traders.

- Real-Time Risk Intelligence Bots We developed Python-based web crawlers using Selenium to extract and validate real-time Country Risk, Bank Risk, and Counterparty Risk data from various financial intelligence sources.

- In-App Notifications Integrated Redis to power a low-latency, real-time notification system for transaction updates, bid status changes, and live banker communications.

- Containerized Infrastructure Leveraged Docker to containerize the full application stack for seamless deployment across environments and consistent performance.

- Django REST Framework Used DRF to build RESTful APIs powering the client frontend and facilitating third-party integrations.

- PostgreSQL as the primary relational database, optimized for transactional integrity and reporting.

- MT-700 Compliance Ensured interoperability with existing banking systems by aligning message formats with SWIFT MT-700 standards.

Success Factors

- Digita’lization Of Trade journey

- Improve Cost to Income Ratio for Trade Finance

- Faster & accurate instrument risk assessment at scale!

- Instant Access to Rates & Trade Facilities

- Interoperability In Trade- MT-700 compliant

- Live Chat with bankers